Pakistan’s real estate is a growing industry. The real estate sector indicates to have supported development after the phase of stagnation in 2017. During the times of Covid, the government has been playing a very constructive role in the real estate sector. Lockdown motivated the government to raise the construction business to industry status which in turn facilitates the real estate business. Record deals were seen in sales of cement paving a smooth path for the registration of real estate companies. ConnectorPk is the right place to come as it connects you with best real estate companies. It could facilitate one to make the best investments in Islamabad.

Advances in the real estate sector:

Pakistan has been lacking a vital living setup over the years. As it requires an extra need for space as well as property dealers. The country lacks to fulfill the basic demand of housing accommodations for citizens. As the finances for construction are even less than 1% of GDP (Gross Domestic Product) and the bottommost one. This can be improved by enhancing the construction in the real estate sector. Real estate being the developing sector in Pakistan is mounting at a fast pace in recent times. It has experienced an increase of 118pc in recent years.

The combined direct contribution of growth and real estate to Pakistan’s GDP (Gross Domestic Progress) has been more than 9% over the last 10 years. Some specific zones like steel, cables, wood, cement, and ceramics have shown an enormous improvement.

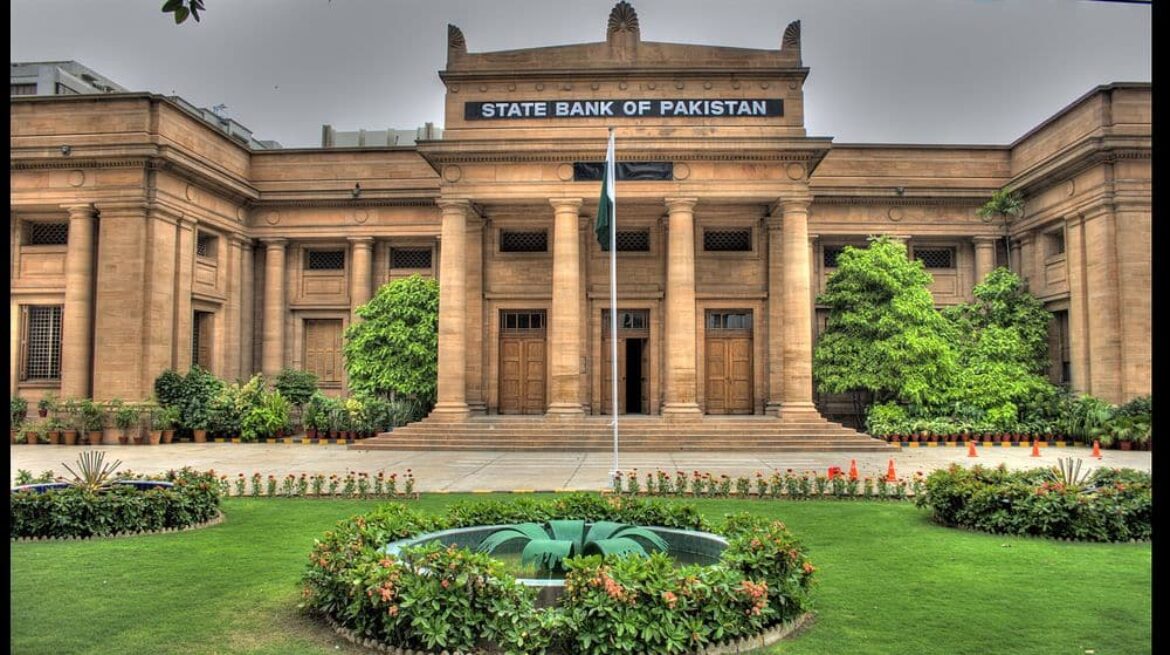

State Bank of Pakistan reforms for Real Estate:

The government of Pakistan aims to enhance housing and construction in the future and has also announced some reforms like removing the restrictions in mortgage and building funding. In this regard, the state bank of Pakistan is trying its best to support the real estate business in Islamabad. It has taken several regulatory steps in support of Pakistan’s government initiative for the development of housing and construction sectors. Banks are now obligated to raise their infrastructure to meet the goals of the government and state bank of Pakistan. It is providing support to real estate companies and development projects because they could lead to massive revenue.

- SBP facilitates the real estate sector by modifying its capital adequacy regulations.

- Risk weight on banks/DFIs (Development Finance Institutions) investments has been reduced from 200% to 100%.

- SBP makes it mandatory to increase the limit for mortgage finances and funding for builders and constructors.

- Banks are obligated to improve the building loan portfolios to 5% of their private sector credit.

- SBP has also instructed banks to represent an action plan in 15 working days having quarterly targets, campaigns, and technology infrastructure.

- Banks are also advised to monthly account for the sanctions and expenses following the targets.

- Banks will store the amendments in capital sufficiency investments of banks in a banking book rather than a trading book.

- It would also be beneficial for the banks as they could place their investments in real estate without devoting a huge amount.

- Employing financing has given a rise to bank/DFI’s (Depository Financial Institution) participation.

- SBP makes use of existing prudential regulations for corporate and commercial banking and modifies them to boost up bank’s participation and investment in REITs (Real Estate Investment Trusts).

To get an opportunity to communicate with best real estate companies in Islamabad and property dealers, connect with ConnectorPk.

Potential Benefits:

For REITs:

Practically, REITs (Real Estate Investments Trusts) support the real estate sector investments. REITs are mostly unregulated as they lack major development due to taxes. They are closed-end mutual funds organizations that own, support, and operate profitable real estate. They allow people to take advantage of real estate by investing in a range of real estate properties. These companies use funding from the community as well as institutions. Afterwards, REITs make investments in real estate properties by deploying the collected funds.

This investment eventually raises the commercial evolution. It would be beneficial for bringing the capital towards REITs and allowing banks/DFIs to introduce diversity in their investments. REITs would be able to get finances from banks rather than depending on their resources. Thus, their overall market engagement would be increased. This will give a boost to REIT companies to accelerate the schema of housing and construction. This is a smart initiative, as it reduces the risks associated with real estate investments. Banks will easily invest in REITs and can launch new REITs.

For Banks and Financial Institutions:

Modifications in SBP reforms will result in higher investments in REITs by banks/DFI’s as it will now tune their 15 % equity rather than 10%. Banks will be able to enhance investments in REITs without assigning a huge amount of capital. It is not only constrained to banks but also results in increased participation of financial institutions.

In addition to that, the central bank makes it possible for banks to count their investments in REIT management organizations. It has allowed banks to invest in REIT management organizations, bonds, shares to achieve the targets for construction and housing. This initiative of SBP will further motivate the banks to play their role in enhancing the capital market of the real estate sector. It will also regulate the involvement of financial institutions sponsored by supervised initiatives.

For real estate companies and Investors:

State bank of Pakistan has now lifted the restriction on seeking finances against the share of groups of organizations. Hence investors will be able to invest in new business domains thus, increasing the pace of economic growth. In addition to that, company sponsors would be encouraged to be listed on the stock exchanges. Connector pk provides you ways to invest in secure projects like Hills Avenue, AH theme Avenue and so on. Connect with ConnectorPk today, to get in touch with best real estate companies in Islamabad.

Conclusion:

Investing in real estate has different classes and levels; a different type of investment is suited for different kinds of people. Generally, if you are a common-businessman or a worker and are looking for real estate business in Islamabad then you ought to either decide to purchase a plot and sell it later or purchase a house, shop, and so forth and lease them since, this sort of venture is by and large simple and requires less beginning capital. If you are into investing in real estate and want to buy apartments in Islamabad, then Connector is the place for you to come as we can provide you some of the best and luxurious apartments in the town with promising return and connects you with best Property dealers in Islamabad.

Comments (1)